Article 24a FZG requires that every January, pension funds and vested benefits institutions notify the Central Office of all pension asset holders on record in December.

Form of reporting

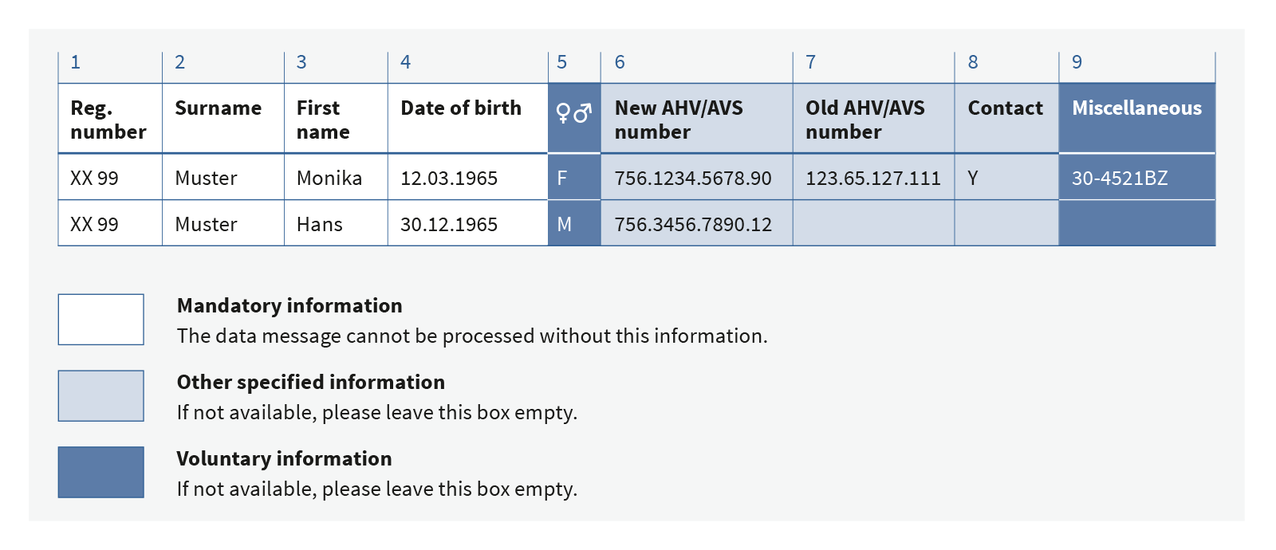

The Guarantee Fund has made a web portal available for the purposes of the annual reporting. The reporting must be done via this web portal in the form of a structured data set (CSV format), or using a web service (XML format).

Contact information 2nd Pillar Central Office

Would you like to send questions to the 2nd Pillar Central Office?

We gladly respond to written requests.

2nd Pillar Central Office

LOB Guarantee Fund

Business office

P.O Box 1023

3000 Berne 14

Phone: +41 31 380 79 75

Fax: +41 31 380 79 76

info@zentralstelle.ch

Form: Registration/mutation of the contact person for reporting to the 2nd Pillar Central Office

Data security and data protection

Please note that all personal data made available to the LOB Guarantee Fund will be handled in accordance with the provisions of the Data Protection Act and protected against unauthorised processing by appropriate technical measures.