Duty to pay contributions

The benefit schemes covered by the Vesting Law are affiliated to the Guarantee Fund which they finance (Art. 57 und 59 LOB).

A benefit scheme is governed by the Vesting Law (FZG) if it grants an entitlement to a benefit on the basis of its regulation, on reaching the age limit, on death or in the event of disability (insured event) (Art. 1 para. 2 FZG).

The following schemes must settle contributions to the Guarantee Fund:

- All benefit schemes registered under Art. 48 LOB (compulsory benefits under LOB).

- All unregistered benefit schemes with regulatory benefit commitments (strictly non-compulsory benefits).

Since the year 2000, unregistered benefit schemes which give benefit commitments have been required to settle contributions.

Contribution statement

General

The “Notification / Statement of Contributions” form issued by the Guarantee Fund comprises two parts:

- Part A relates to contributions for subsidies and is only to be completed by benefit schemes registered under Art. 48 LOB.

- All benefit schemes are required to complete Part B.

When making the statement, please note the following points:

- The closing date for sending in the statement and payment of the contribution is 30 June of the following year.

- An application for an extension of the deadline must be submitted in good time in writing (the period cannot be extended beyond the end of the following year).

- Major foundations are requested to pay an instalment as of 30 June within the framework of the presumed contribution (only if the statement form is received late).

- The Foundation Auditor designated pursuant to Art. 52a LOB must also sign the settlement form. Confirmations by the auditors of third parties are not sufficient.

- Contribution corrections for previous years (because of retroactive changes, for example) become liable for contributions or benefits only for the five previous assessment years if the difference is CHF + / - 5.-.

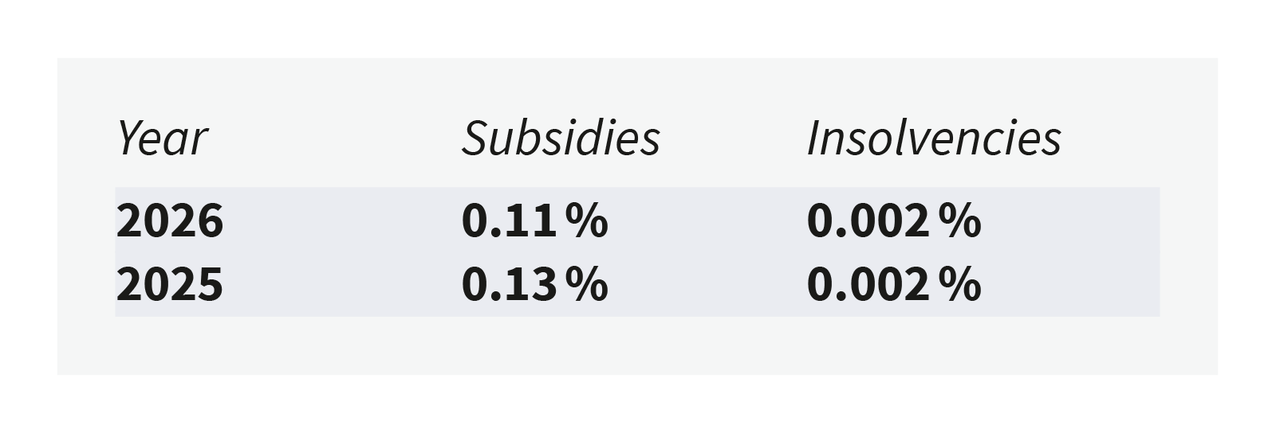

Contributions

Three practical example

(the figures are assumptions, as are the basic values)

Benefit scheme for several companies