Restriction of Cash Payment After Departure Abroad

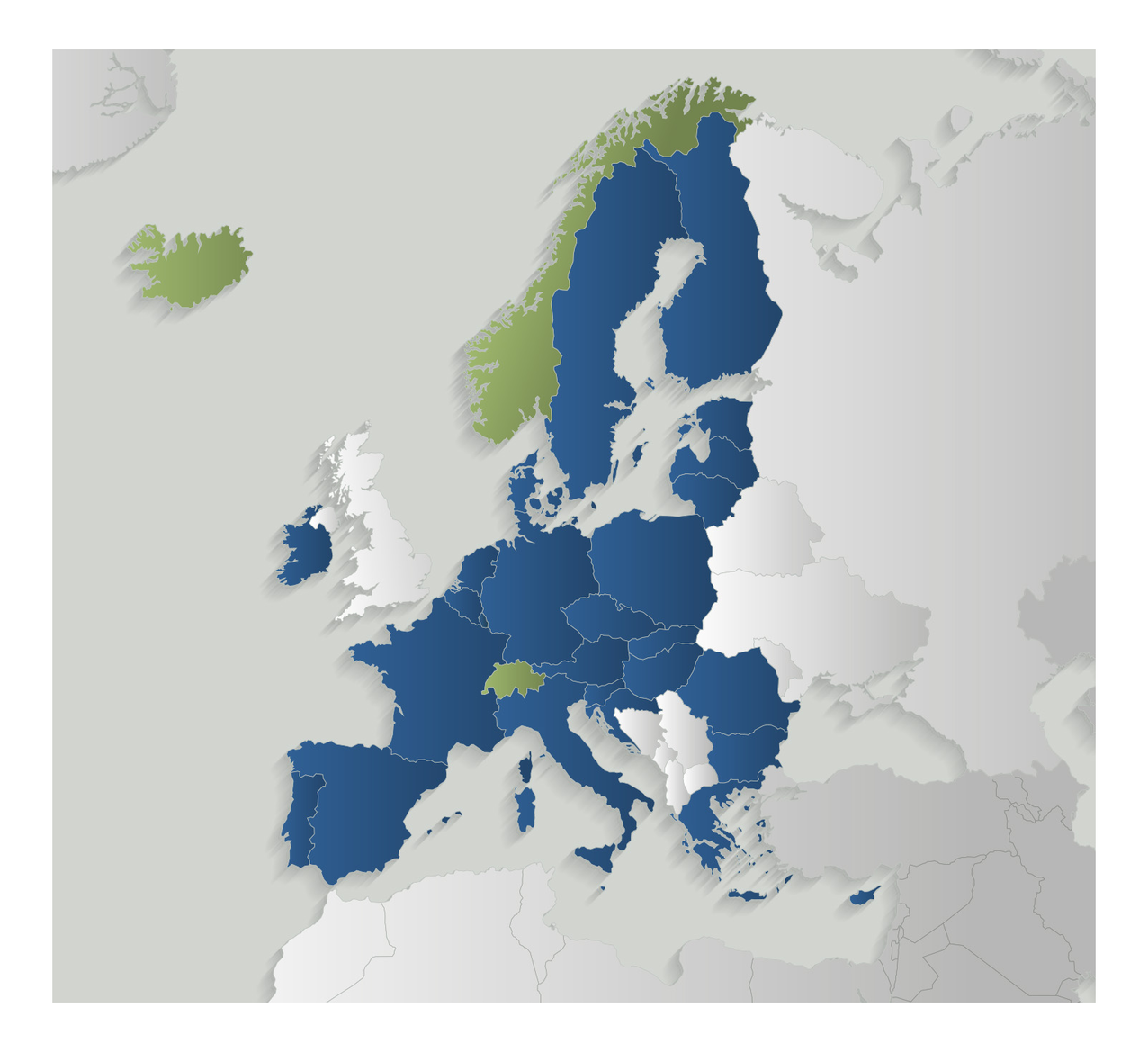

A person leaving Switzerland permanently to settle in an EU or EFTA country and requesting the cash payment of their occupational pension assets must provide proof that they are not subject to compulsory insurance for old age, disability and survivors’ benefits in the country concerned.

The cash payment of pension assets upon departure abroad is not possible in the following circumstances:

- Departure takes place after 31.5.2007 and

- the cash payment relates to a credit balance from the statutory minimum benefits (LOB) and

- the insured person moves to an EU or EFTA country and

- the person concerned must have compulsory state insurance for retirement, disability and survivors' benefits in the new country.

A person taking up self-employment activities in a member state of the EU or EFTA is not entitled to refund of compulsory savings balances if the person is still required to have compulsory pension, disability and survivors' benefit insurance in the member state concerned.

If the occupational benefit credit balance of a particular person comprises benefit claims under both compulsory and non-compulsory schemes, only the benefit from the compulsory scheme can no longer be paid out in cash. If any one of the above points is not satisfied, the entire credit balance can still be drawn in cash on departure abroad.

Cash payment is not allowed if an insured person leaves Switzerland permanently to live in Liechtenstein.

If the cash payment is not possible, the credit balance will be retained in Switzerland on a blocked account (vested benefits account or vested benefits policy). On reaching ordinary retirement age or no less than five years before ordinary retirement age, the credit balance is paid out to the person concerned. No transfer of the credit balance from an occupational benefit scheme to the foreign social insurance scheme will be made.

Exceptions

(No clarification by LOB Guarantee Fund needed)

The capital pay-out is possible without verification of the insurance situation in the country of destination, provided that the disbursement takes place as a retirement benefit. Assets held in vested benefit accounts or policies may be withdrawn in cash as of five years prior to the reference age of the OASI.

Credit balances from occupational benefit schemes may also be disbursed without Guarantee Fund clarification if they are in excess of the statutory minimum benefits (called non-compulsory credit balances).

The possibility of withdrawing funds early in order to buy a residential property is not affected by the limitations and this may be done without Guarantee Fund clarification.

In the event of departure to a country outside the EU or the EFTA, no clarification of the insurance situation by the Guarantee Fund is needed.

Clarification of the Insurance Obligation:

How do I proceed?

The LOB Guarantee Fund has elaborated cooperation agreements regarding the clarification of the compulsory social insurance liability with the social insurance authorities of various states and correspondingly prepared application forms.

Tasks of the liaison office

The EU law embodied in the agreement on the freedom of movement of persons stipulates the existence of liaison offices for international contacts between the insurers and the institutions and individuals. The LOB Guarantee Fund is the liaison office for Switzerland in the range of occupational benefits.

As the liaison office, the LOB Guarantee Fund is able to communicate directly with the liaison offices abroad.

Persons and occupational benefit schemes can contact the foreign insurers either directly or via the Guarantee Fund. Similarly, foreign insurers or persons can directly contact the Swiss occupational benefit schemes or do so via the Guarantee Fund.

In cases where contact exists between an insurer and a person residing in a different country, communication will take place directly between the insurance scheme and the person concerned.